What Does the Acronym Ehr Stand for

Find answers to your Medicare Access and Chip Reauthorization Act of 2015 (MACRA) questions and stay up to date on current QPP requirements for 2002. Learn the difference between MIPS and APMS. MACRA FAQs help you with information on eligibility criteria and other key factors for MIPS and APMS.

-

The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) is a law that reformed the Medicare payment system. MACRA repealed the Sustainable Growth Rate (SGR) formula used to update the Medicare Physician Fee Schedule (MPFS) and thereby determine physician reimbursement. The SGR was replaced with a "value-based" payment system that incorporates quality measurement into payments with the goal of creating an equitable payment system for physicians. MACRA also reauthorized the Children's Health Insurance Program (CHIP).

-

What is the Quality Payment Program (QPP) and how does it relate to MACRA?

The Quality Payment Program (QPP) is a payment reform initiative legally required by MACRA and created by the Centers for Medicare & Medicaid Services. The QPP establishes value-based healthcare business models that link an ever-increasing portion of physician Medicare Part B reimbursement to service-value rather than service-volume. The incentive-based business models, collectively referred to as the QPP, provide two participation tracks for eligible clinicians—the Merit-based Incentive Payment System (MIPS) and Alternative Payment Models (APMs)—both of which involve levels of financial rewards and risks.

-

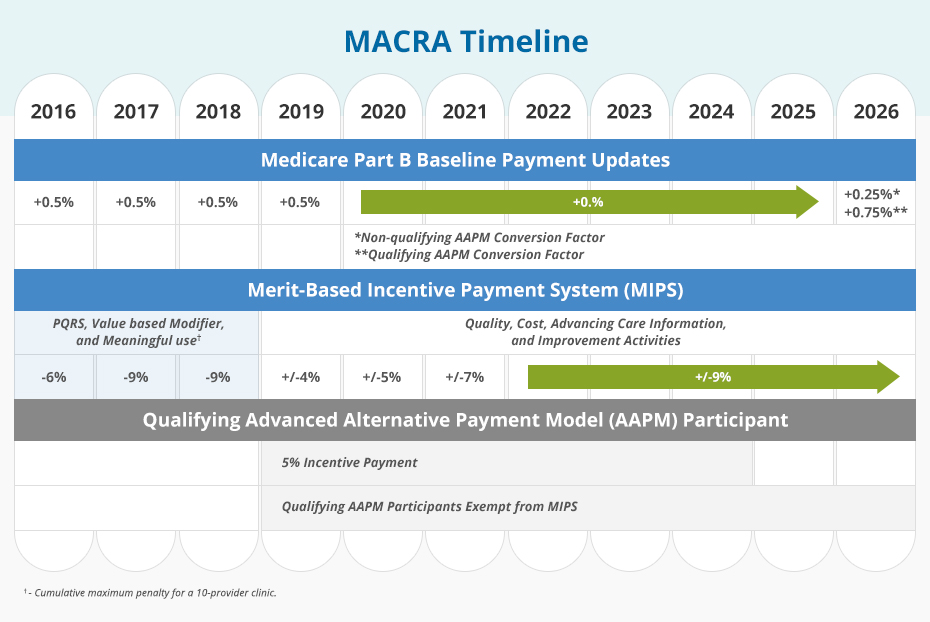

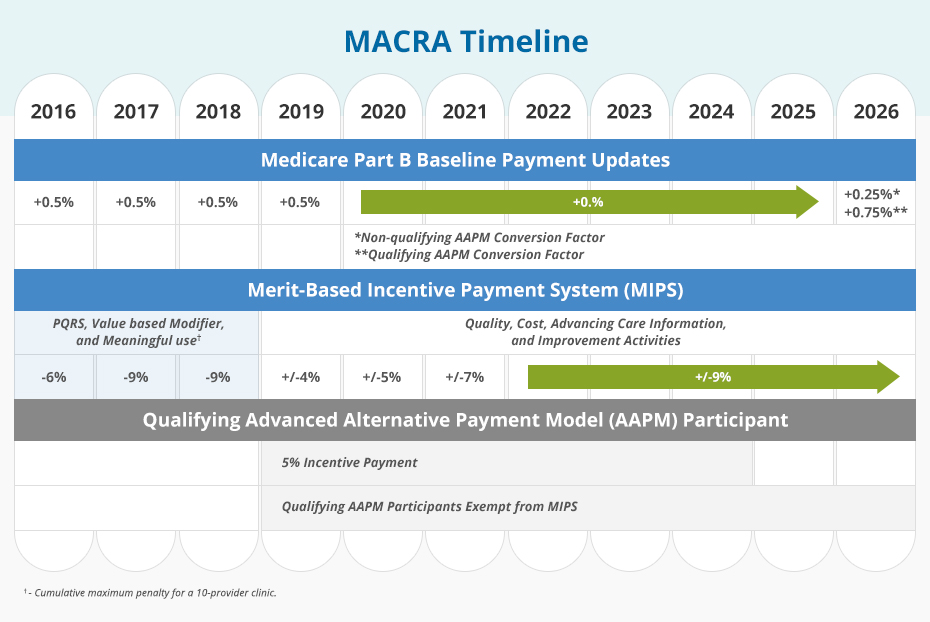

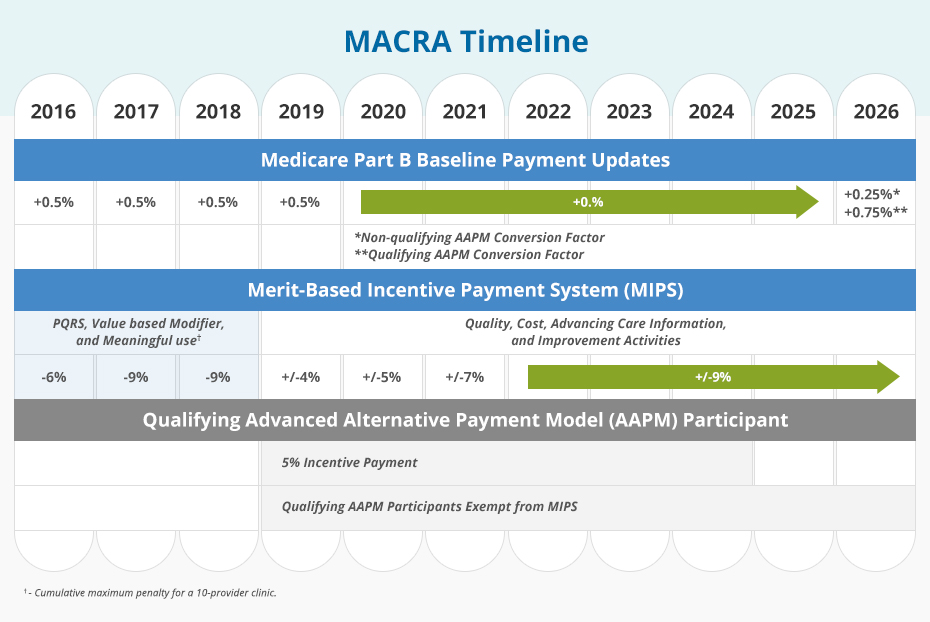

What is the timeline for MACRA?

Instead of requiring eligible clinicians to fully participate in either the MIPS or an Alternative Payment Model (APM) in 2017, CMS extended the transition timeline to provide flexibility to practices that needed more time to prepare for MACRA's requirements. For Year 1 (2017) eligible clinicians had 4 options, or participation levels, from which to choose for the MACRA reporting period.

Choosing from 1 of the 4 options ensured that participants of the Year 1 QPP avoided penalty in the corresponding payment year (2019). MACRA transition options included:

Option 1: Test the QPP (and avoid penalty in 2019) by submitting some data after January 1, 2017

Option 2: Participate for part of the 2017 calendar year

Option 3: Participate for the full 2017 calendar year

Option 4: Participate in an advanced APMPractices that did not submit any quality data received a payment penalty in 2019, while practices that chose options 2 and 3 potentially qualified for a bonus payable in 2019. The size of the payment bonus varied based on the level of participation.

Resulting from the 2017 performance year, Advanced APMs participants could potentially earn a 5% bonus in the 2019 payment year. While Advanced APM performance years 2017 and 2018 were only applicable to Medicare patients and payments, the opportunity for eligible clinicians to meet an alternative standard extended to include non-Medicare patients and payments started in 2019.

-

How will I be scored under MIPS?

For the 2017 performance year (2019 payment year), MIPS final scores are based on performance in the following categories (performance category weights are in parentheses):

- Improvement Activities (15%)

- Advancing Care Information (25%) (if exempt, weight shifts to Quality)

- Quality (60%)

- Cost (0%)

For the 2018 performance year (2020 payment year), MIPS final scores are based on performance in the following categories:

- Improvement Activities (15%)

- Promoting Interoperability (25%) (if exempt, weight shifts to Quality)

- Quality (50%)

- Cost (10%)

For the 2019 and 2020 performance years (2021 and 2022 payment years), MIPS final scores are based on performance in the following categories:

- Improvement Activities (15%)

- Promoting Interoperability (25%) (if exempt, weight shifts to Quality)

- Quality (45%)

- Cost (15%)

-

How does MACRA affect me if I am in a large multi-specialty group?

Clinician groups have two options:

Report as a group– In this case, all clinicians who bill under the stated group's TIN will automatically be counted as part of the group and receive the adjustment. Select eligible clinicians within the group may not report individually.

Reporting as an individual– In this case, each eligible clinician reports individually and earns an individual performance score and payment adjustments based on individual reporting.

If you're in a large multi-specialty group, you'll want to decide whether to report MIPS as a group or as an individual. If you report as a group, all clinicians' data in the group is aggregated, so you should first determine if reporting together will improve your MIPS final score.

-

What are the reporting methods under MIPS?

The reporting requirements under MIPS are outlined in the table below. For data submissions methods, see How do I submit quality measures data?

PERFORMANCE CATEGORY WEIGHT REPORTING REQUIREMENTS Cost 15% No reporting requirement; data pulled from administrative claims.

To be scored:

- Case minimum of 20 for Total Per Capita

- Cost measure

- Case minimum of 35 for MSPB

- Case minimum of 10 for procedural episodes

- Case minimum of 20 for acute inpatient medical condition episodes

Quality 45% Report a full year of data on 6 measures, including 1 outcome or high priority measure, or all measures in a specialty measure set Improvement Activities 15% Groups of 16+ clinicians: Report on a minimum of 4 medium weighted activities or 2 high-weighted activities for at least a continuous 90-day period

Small practices (15 or fewer clinicians): Report 1 high-weighted or 2 medium-weighted activities for at least a continuous 90-day periodPromoting Interoperability 25% - Must use 2015 Edition Certified EHR Technology for more than 90 consecutive days in the performance period

- Submit a "Yes" to the Prevention of Information Blocking Attestation

- Submit a "Yes" to the ONC Direct Review Attestation

- Submit a "Yes" to the Security Risk Analysis measure

- Report the required measures under each objective or claim the exclusions, if applicable

-

Can I participate in MIPS without an EHR?

The Promoting Interoperability performance category factors in meaningful use of a certified EHR for points calculation. An eligible clinician may still be able to participate in MIPS without an EHR, but will not be able to score any points in the this category. In that case, the weighting from the Promoting Interoperability performance category shifts to the Quality performance category. In lieu of a natural disaster, the clinician must submit application to the Centers for Medicare & Medicaid Services (qpp.cms.gov) for exemption for this to occur.

-

Are resident physicians excluded from MIPS?

Resident physicians who are in their first year of Medicare billing are exempt from MIPS. These physicians will be eligible to participate in MIPS in their second year to earn MIPs adjustments.

-

Are there any exemptions from MIPS?

Yes, there are several:

- Clinicians who are in their first year of billing Medicare.

- Clinicians who are not considered "eligible".

- Clinicians who do not meet the low-volume threshold.

- Clinicians in an Advanced APM who are either Qualifying APM Participants or Partial QPs.

-

How will I be paid under an APM?

Advanced Alternate Payment Models (APMs) are a track of the Quality Payment Program that offer a 5 percent incentive to participants in return for meeting certain criteria:

- Require participants to use certified EHR technology

- Provide payment for covered professional services based on quality measures

- Be a Medical Home Model or require participants to bear an 8 percent financial risk.

Only Qualifying APM Participants can earn a 5 percent payment incentive.

-

What is a partial qualifying participant (QP)?

A Partial QP is an eligible clinician who participates in an Advanced Alternative Payment Model (APM) but hasn't met the payment or patient threshold to be considered a Qualifying APM Participant (QP). A Partial QP is ineligible to receive the 5% lump sum bonus. If the Advanced APM is a MIPS APM, and the Partial QP opts to participate in MIPS, the Partial QP will be scored under the APM Scoring Standard.

MIPS eligible clinicians can check their QP status using the QPP Participation Status Tool.

Payment Year 2021 2022 2023 and later Partial QP Payment Amount Threshold Medicare Minimum 20% 20% 20% Total 40% 40% 50% Partial QP Patient Count Threshold Medicare Minimum 10% 10% 10% Total 25% 25% 35% -

What are the requirements for participation in a virtual group?

Clinicians can choose to participate in MIPS as an individual, a group, an APM entity in a MIPS APM, and as a virtual group.

A virtual group is a combination of two or more TINs assigned to one or more solo practitioners or one or more groups consisting of 10 or fewer eligible clinicians that elect to form a virtual group for a performance period for a year.

If a group chooses to join a virtual group, all the clinicians in that group are part of the virtual group. The group's final score and resulting payment adjustment percentage applies to all clinicians in the virtual group. The virtual group eligibility determination period aligns with the first period of data analysis under the MIPS eligibility determination period. For 2020, the determination period is Oct. 1, 2018, to Sept. 30, 2019 (including a 30-day claims run out). Fewer than 10 virtual groups registered for the 2019 performance period, according to CMS.

Eligibility

A virtual group election is considered a low-volume threshold opt-in for any prospective member of the virtual group that exceeds at least one, but not all three, of the low-volume threshold criteria. Clinicians can only participate in one virtual group per performance period. There is no limit on the size of a virtual group.

Virtual groups are held to the same requirements for each performance category as standard groups, and are responsible for aggregating data for their measures and activities across the virtual group. TINs can inquire about their TIN size prior to making an election during a 3-month time frame, which begins Oct. 1 and ends Dec. 31 of the calendar year prior to the applicable performance period.

Election Process

There is a two-stage election process for virtual groups:

Stage 1 (optional): If you're a solo practitioner or part of a group with 10 or fewer eligible clinicians:

- Make any formal written agreements.

- Send in your formal election registration.

- Budget your resources for your virtual group.

Stage 2 (required): The virtual group must have a formal agreement between each solo practitioner and group that composes the virtual group prior to submitting an election to CMS. Each virtual group has to name an official representative who is responsible for submitting the virtual group's election. Elections must be submitted via e-mail to MIPS_VirtualGroups@ cms.hhs.gov by December 31 of the preceding year you intend to operate as a virtual group.

The data submission criteria applicable to groups are also generally applicable to virtual groups, except for data completeness and sampling requirements for the CMS Web Interface and CAHPS for MIPS survey:

- Data completeness for virtual groups applies cumulatively across all TINs in a virtual group. There may be a case when a virtual group has one TIN that falls below the 60 percent data completeness threshold, which is an acceptable case as long as the virtual group cumulatively exceeds such threshold.

- The CMS Web Interface and CAHPS for MIPS survey sampling requirements pertain to Medicare Part B patients with respect to all TINs in a virtual group, where the sampling methodology will be conducted for each TIN within the virtual group and then cumulatively aggregated across the virtual group. A virtual group would need to meet the beneficiary sampling threshold cumulatively as a virtual group.

-

Are there any exemptions from MIPS for extreme circumstances?

CMS provides hardship exceptions designed to meet the needs of small practices, practices located in rural areas, non-patient facing individual MIPS eligible clinicians or groups, and individual MIPS eligible clinicians and groups that participate in a MIPS APM or a Patient-centered Medical Home.

In the wake of hurricanes Harvey, Irma, and Maria, CMS added a natural disaster provision for extreme and uncontrollable circumstances in the MACRA Year 2 Final Rule (2018). This provision automatically exempts MIPS eligible clinicians affected by a natural disaster or public health emergency in a designated region (such as FEMA-designated major disaster) for the performance year.

These MIPS eligible clinicians, identified as affected by the automatic extreme and uncontrollable policy, will have their four performance categories automatically reweighted to 0% unless they submit data for two or more performance categories. This policy applies only to the eligible clinicians so identified, and not to group or virtual group participation.

If extreme and uncontrollable circumstances—such as a practice closure, severe financial distress, or vendor issue—render an eligible clinician unable to submit MIPS data, the clinician can apply for reweighting of any or all MIPS performance categories. Significant hardship exception applications must be submitted by Dec. 31 of the performance year. If granted, exceptions will extend to the eligible clinician's group or virtual group.

-

What are Patient-facing Encounters?

Patient-facing encounters are in-person visits where the MIPS eligible clinician is in the physical presence of the patient. The MIPS eligible clinician then bills these patient-facing services (general office visits, outpatient visits, and procedure codes) under the Medicare Physician Fee Schedule.

-

What is the Patient-facing Encounter Codes List?

Patient-facing encounter codes determine non-patient facing status. The list of patient-facing encounter codes includes evaluation and management (E/M) codes and surgical and procedural codes.

This list is used to determine the non-patient facing status of MIPS eligible clinicians.

- An individual who bills 100 or fewer patient-facing encounters (including telehealth)

- A group with 75% of the clinicians billing under the group's TIN meeting the definition of a non-patient facing individual

-

Who is considered a non-patient facing clinician?

A non-patient facing MIPS eligible clinician is a clinician who meets or exceeds the low-volume threshold but only bills Medicare for 100 or fewer patient-facing services (including telehealth services) under Medicare Part B during one or both of the 12-month segments of the MIPS determination period. Groups and virtual groups also qualify for this special status when more than 75% of the clinicians in the group or virtual group are non-patient facing eligible clinicians. Non-patient facing eligible clinicians are afforded more flexible reporting options under MIPS.

-

How long should I retain documentation?

You should keep all documentation to support your MIPS data submission for at least 6 years, as CMS may request to audit your patient medical records. You have 45 days to comply with the request.

Quality—Past precedence with CMS PQRS audits indicates that it is important to retain archived EHR patient-level snapshots of the entire period of data reported upon. In addition, certain 3rd-party data submission entities such as qualified registries and QCDRs are subject to annual CMS audit requirements which may involve the providers and groups they serve.

Improvement Activities—Because this performance category will be reported through attestation, it will be important for clinicians to maintain documentation that justifies their Yes/No statement that an activity was performed during the reporting period, in case of an audit. A group or virtual group may attest to an improvement activity when at least 50%t of MIPS eligible clinicians in the group participate in or perform the activity. At least 50% of the group's NPIs must perform the same activity for the same continuous 90 days in the performance period.

Cost—No separate auditing requirements apart from the usual auditability of the administrative claims upon which the cost measures are based.

Promoting Interoperability—Pay special attention to retaining documents supporting the annual IT security risk assessment applicable to the reporting period.

-

Does MIPS payment adjustment apply to Part B drugs?

MACRA legislation requires MIPS payment adjustments be made to payments for both items and services under Medicare Part B, including Part B drugs.

-

How do I submit quality measures data?

MIPS clinicians or groups (billing Medicare Part B using a common TIN) can choose from the collection types in the table below:

MIPS DATA SUBMISSION OPTIONS

PERFORMANCE CATEGORY INDIVIDUAL GROUP Quality - Qualified Clinical Data

- Registry (QCDR)

- Qualified Registry

- EHR

- Claims

- QCDR

- Qualified Registry

- EHR

- Administrative Claims

- CMS Web Interface

- CAHPS for MIPS

Promoting Interoperability - QCDR

- Qualified Registry

- EHR

- Direct Attestation

- QCDR

- Qualified Registry

- EHR

- Direct Attestation

- CMS Web Interface

Improvement Activities - QCDR

- Qualified Registry

- EHR

- Direct Attestation

- QCDR

- Qualified Registry

- EHR

- CMS Web Interface

- Direct Attestation

Cost - Administrative Claims

- Administrative Claims

-

Where can I find quality measures and codes for MIPS?

CMS provides for the patient relationship categories and codes to facilitate the attribution of patients and episodes to clinicians.

In some cases, the cost of care may be attributed to more than one physician. The use of patient relationship codes ensures the attribution of patients and care episodes to clinicians who serve patients in different roles. Patient relationship codes distinguish the relationship and responsibility of a clinician with a patient at the time of service. To ensure CMS properly attributes Cost measures, MIPS eligible clinicians should append the following HCPCS Level II modifiers to procedure codes, as applicable:

- X1 Continuous/Broad Services

- X2 Continuous/Focused Services

- X3 Episodic/Broad Services

- X4 Episodic/Focused Services

- X5 Only as ordered by another clinician

-

What are the key changes to the 2020 Quality Payment Program?

Notable changes to the QPP for Year 4 involve:

- Payment threshold changes

- Payment adjustment changes

- Definition of hospital-based clinicians

- Finalized MIPS Value Pathways (MVP) for Performance Year 2021

-

What does MACRA mean for medical organizations?

The QPP and its options under MIPS and Advanced Alternative Payment Models (APMs) aim to revitalize the doctor-patient relationship, putting the care of people first while making the process of practicing medicine more efficient.

From a financial perspective, CMS estimates that MIPS eligible clinicians who participated in the QPP earned an average 1.4% payment adjustment in 2019, while MIPS eligible clinicians who did not participate lost an average -8.2%.

But MACRA's push for value-based compensation will have additional impacts beyond measurement and payment change. Because providers will be paid based on patient outcomes, eligible clinicians will need to know what happens across the system, beyond their offices. To effectively manage patient care, they need solid, accurate data—often relying on multiple delivery systems. This means that the technology and data infrastructure will need to change.

MIPS data reporting will only succeed when community-wide data can be aggregated and quickly and efficiently assessed. Data sharing standards are an essential component of MACRA that will enable significant changes in patient care.

-

What does MACRA mean for medical coders?

Quality care is tied to medical coding, and medical coding is tied to reimbursement. To have a coder on the team who understands the QPP is essential for clinicians to earn full credit for the quality care they provide to applicable patients

Since Hierarchical Condition Categories (HCCs) factor into the risk adjustment score used by CMS to predict future costs, it's imperative that coding professionals code to highest level of specificity and understand HCC code mapping and selection to receiving proper credit in MIPS. This is especially influential to earn the complex patient bonus, which relies on HCC coding to capture risk scores that demonstrate the severity of illness, or risk factors, of the clinician's patient population.

-

What are Hierarchical Condition Categories (HCCs) and how do they relate to MACRA?

Hierarchical Condition Categories (HCCs) are categories of medical conditions that correlate to a corresponding group of ICD-10 diagnosis codes. The selection of HCC categories, each of which has a weight assignment, is used for risk adjustment payments. Specific diagnoses drive the HCC selection, and, in return, affect risk adjustment scores.

With the growth of population health payment, HCCs have become integral to determining payment rates for all Medicare beneficiaries based on the illness burden of each patient. In fact, HCCs have become so important that both Medicare and non-Medicare plans (commercial and Medicaid) are using risk adjustment methodologies to determine payments and adjust quality indicators.

Medical coders need to get up speed on HCC coding, risk adjustment coding, and risk adjustment factor (RAF) scores because these variables factor heavily into MACRA success. Payment adjustments are determined based on MIPS final scores, which are partially driven by the coding of HCCs, making HCC capture vital.

Keep in mind the following points about MACRA and HCC coding:

- To be successful under MACRA, providers, coders, and CDI professionals must have a good understanding of the payment models.

- MACRA has increased the need for implementation of CDI programs and for coders to be trained regarding HCC coding selection.

- Coding for HCC mapping can have a big impact on reimbursement under both MIPS and Advanced AMPs.

-

What is a MACRA code?

MACRA codes are used by medical coders to report Cost and Quality measures. The MACRA patient relationship codes are Healthcare Common Procedure Coding System (HCPCS) Level II modifier codes that enable clinicians to self-identify their relationship with and responsibility for a patient at the time of furnishing an item or service.

Clinicians may report patient relationships on claims by adding one of the patient relationship codes in the same manner that modifier codes are submitted on each claim line for a rendered service. This method of reporting patient relationships allows clinicians to report different patient relationships for separate items and services billed on the same claim.

-

What are Quality Data Codes (QDCs)?

Medical coders for small practices, as defined by CMS, can report for the MIPS Quality category when an eligible CPT® or ICD-10 code is used for an encounter. To collect and submit quality data through Medicare Part B claims, coders attach quality data codes (QDCs) to their Medicare Part B claims throughout the performance year.

QDCs are specified CPT® II codes and G codes used for submission of quality data for MIPS. You'll also need to apply encounter codes, including ICD-10-CM, CPT® Category I, or HCPCS Level II codes to show which patients should be added toward the denominator/numerator of the quality measure.

Medicare Part B claims require certain billing codes appended to denominator-eligible claims to indicate the required quality action or exclusion occurred.

MACRA provides for the patient relationship categories and codes to facilitate the attribution of patients and episodes to clinicians.

In some cases, the cost of care may be attributed to more than one physician. The use of patient relationship codes ensures the attribution of patients and care episodes to clinicians who serve patients in different roles. Patient relationship codes distinguish the relationship and responsibility of a clinician with a patient at the time of service. To ensure CMS properly attributes Cost measures, MIPS eligible clinicians should append the following HCPCS Level II modifiers to procedure codes, as applicable:

- X1 Continuous/Broad Services

- X2 Continuous/Focused Services

- X3 Episodic/Broad Services

- X4 Episodic/Focused Services

- X5 Only as ordered by another clinician

The last day to submit Medicare Part B claims with QDCs for a performance period is determined by the regional Medicare Administrative Contractor (MAC) but must be processed no later than 60 days after the close of the performance period.

-

What is MIPS?

The Merit-based Incentive Payment System (MIPS), established by the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) is a pay-for-value Medicare Part B track of the QPP based on the consolidation of three existing quality and value reporting programs: the Physician Quality Reporting System, Value-Based Payment Modifier Program, and Medicare EHR Incentive Program.

-

What's the difference between individual and group participation?

According to CMS, an individual is defined as a single National Provider Identification (NPI) tied to a Tax Identification Number (TIN). A group refers to a set of clinicians sharing a common TIN, no matter the specialty or practice site.

-

How have MIPS performance categories changed?

The Advancing Care Information category was renamed to Promoting Interoperability in 2019. As of Year 3, the four MIPS performance categories are Quality, Cost, Promoting Interoperability (PI), and Improvement Activities. Categories weights are subject to change, as seen in the table below:

PERFORMANCE CATEGORY Year 1

2017Year 2

2018Year 3

2019Year 4

2020Quality 60% 50% 45% 45% Cost 0% 10% 15% 15% Improvement Activities 15% 15% 15% 15% Advancing Care Information 25% 25% Promoting Interoperability 25% 25% -

What milestones should I know for the 2020 MIPS performance period?

If you're participating in MIPS in 2020, also referred to as Year 4, the performance period starts January 1, 2020 and ends on December 31, 2020.

MIPS Participation: Key Dates for Year 4

Jan. 1, 2020 Jan. 2020 Oct. 3 2020 Nov./Dec. 2020 Dec. 31, 2020 Jan. 2, 2021 — March 31, 2021 July 2021 Jan. 1, 2022 — Dec. 31, 2022 2020 MIPS performance period begins Preliminary 2020 MIPS eligibility is available The last day to begin data collection for a continuous 90-day performance period for the Improvement Activities and/or Promoting Interoperability performance categories Final 2020 MIPS eligibility is available (for nonAPM participants) - 2020 MIPS performance period ends

- Deadline for submitting a Promoting Interoperability Hardship Exception Application

- Deadline for submitting a QPP Extreme and Uncontrollable Circumstance Exception Application (available for all performance categories)

2020 MIPS performance period data submission window 2020 MIPS final score and performance feedback available 2022 Payment adjustments based on 2020 MIPS performance period performance are applied to payments made for Part B covered professional services payable under the Physician Fee Schedule -

Is MIPS scoring different for non-patient facing eligible providers?

A non-patient facing MIPS eligible provider is one who bills 100 or fewer patient-facing encounters (including Medicare telehealth services) during the non-patient facing determination period.

Groups and virtual groups with more than 75% of NPIs billing under the group's TIN meet the definition of a non-patient facing individual MIPS eligible provider during the non-patient facing determination period.

The MACRA statute allows for flexibility in the application of measures and activities required by "non-patient facing" providers. Special MIPS scoring adjustments include:

- Reweighting the Promoting Interoperability performance category to 0 and

- Reallocating the performance category weight of 25% to the Quality performance category

-

What is a MIPS virtual group?

A virtual group is a combination of two or more TINs assigned to one or more solo practitioners or one or more groups consisting of 10 or fewer eligible clinicians that elect to form a virtual group for a performance period for a year.

The MACRA statute allows CMS to establish virtual groups for purposes of reporting and measuring performance under MIPS to help smaller practices by pooling resources.

Virtual groups can consist of solo practitioners and small group practices (groups of 10 or fewer eligible provider) that unite "virtually" to report on MIPS requirements as a collective entity. The members of a virtual group share the same financial adjustments as the result of that reporting. As well, all NPIs billing under the TIN joining the virtual group must participate.

Each MIPS eligible provider in a group (not participating in a MIPS APM or Advanced APM) will receive a MIPS payment adjustment based on the virtual group's combined performance assessment. Adjustment will be applied at the TIN/NPI level.

If there is a portion of the TIN participating in a MIPS APM or Advanced APM, they will receive a MIPS adjustment based on that standard. Participants may be excluded from MIPS if they achieve QP or Partial QP status.

Virtual group election is considered a low-volume threshold opt-in for any prospective member of the virtual group that exceeds at least one, but not all three, of the low-volume threshold criteria. Clinicians can only participate in one virtual group per performance period.

CMS is not imposing additional classifications to virtual group composition (by geographic area or specialty). Nor has CMS established a limit on the number of TINS that may form a virtual group.

-

What are the Promoting Interoperability measures for the 2020 performance period?

Required measures for the 2020 performance period in the MIPS Promoting Interoperability performance category include:

- e-Prescribing

- Query of Prescription Drug Monitoring Program (PDMP)—Bonus (not required)

- Support Electronic Referral Loops by Sending Health Information

- Support Electronic Referral Loops by Receiving and Incorporating Health Information

- Provide Patients Electronic Access to Their Health Information

- Report to two different public health agencies or clinical data registries for any of the following:

- Immunization Registry Reporting

- Electronic Case Reporting

- Public Health Registry Reporting

- Clinical Data Registry Reporting

- Syndromic Surveillance Reporting

-

What is the difference between MIPS and APMs (MIPS vs APMs)?

The majority of eligible healthcare professionals opted to begin their QPP participation in the MIPS track. In the first payment year of MIPS (2019), most MIPS eligible clinicians or groups received a 4% upward (or downward) payment adjustment based on their final performance score.

The MIPS payment adjustment is slated to increase gradually until capped in 2022 at 9%. To avoid the MIPS payment adjustment, some providers evaluate the benefits of moving from the MIPS track into advanced APMs. The biggest difference between MIPS and APMs is that APMs participants assume greater financial risks but can potentially receive greater financial rewards, such as a 5% bonus for qualifying participants in an advanced APM.

- Merit-based Incentive Payment System (MIPS): Clinicians eligible for the MIPS track must report clinician performance across four categories. The data you report is related to evidence-based and practice-specific data you submit to show you provided high-quality, efficient care supported by technology. You do this by sending in information in the following categories: Quality, Improvement Activities, Promoting Interoperability, and Cost. You can earn a performance-based payment adjustment to your Medicare payment for participation in the MIPS track.

- Advanced Alternative Payment Models (also known as Advanced APMs): APMs are approaches to paying for healthcare that incentivize clinicians to provide high-quality and cost-efficient care. APMs let you earn more for taking on some risk related to patients' outcomes. They can apply to a specific condition, episode of care, or a population. You have the opportunity to earn an incentive payment for participating in an innovative payment model.

-

How does MIPS scoring work in 2020?

MIPS scoring has remained the same as performance period 2019 with a few exceptions:

- Quality measures must meet a 70% data completeness threshold.

- Reported measures that fall below this threshold will receive 0 points (except for small practices that will continue to receive 3 points).

- A flat percentage-based benchmark will be applied to certain quality measures to avoid potentially incentivizing inappropriate treatment.

- For group reporting, at least 50% of the clinicians in the group must perform an improvement activity for the group to receive credit for the improvement activity.

- The performance threshold is set at 40 points.

- The additional performance threshold for exceptional performance is set at 85 points.

- Quality measures must meet a 70% data completeness threshold.

-

What is the MIPS budget neutrality factor?

MIPS is budget neutral, which means that payment incentives are made on a sliding scale. CMS allocates the money it saves from providers who receive payment reductions to fund incentive rewards to providers based on their performance in the four MIPS categories. The maximum upward adjustments are capped at three times the maximum negative adjustment.

Because the QPP is budget neutral, all incentive payments received in a given payment year depend on the number of providers sharing the $500 million MACRA allocated for this purpose.

-

What is the MIPS payment Timeline?

Based on the MIPS composite performance score, providers will receive positive, negative, or neutral adjustments to the base rate of their Medicare Part B Payment that will increase each year from 2019 (+4% to -4%) through 2022 (+9% to -9%), when adjustment levels stabilize. The MIPS composite performance score will be determined by performance measures established in the forthcoming MACRA rules.

Merit-Based Incentive Payment System (MIPS) Implementation:

- 2019 – Providers subject to -4% to +4% base rate adjustment for Medicare Part B reimbursements

- 2020 – Providers subject to -5% to +5% adjustment

- 2021 – Providers subject to -7% to +7% adjustment

- 2022 and beyond – Providers subject to -9% to +9% adjustment

-

What's the maximum negative payment adjustment for the 2020 performance period?

As specified in MACRA, the maximum negative payment adjustment for the 2022 payment year and beyond is -9%. The actual adjustment you will receive in the 2022 payment year will be based on your MIPS final score from the 2020 performance period.

-

How many points do I need to avoid a negative payment adjustment for the 2020 performance year?

The performance threshold is the number against which your final score is compared to determine your payment adjustment. The performance threshold for the 2020 performance period is 45 points. See the table below for more information about the relationship between 2020 final scores and 2022 payment adjustments.

MIPS Final Score: 2020 Performance Period Payment Impact for MIPS Eligible Clinicians in the 2022 Payment Year 0.00 – 11.25 points -9% payment adjustment 11.26 – 44.99 points Negative payment adjustment (greater than -9% and less than 0%) 45.00 points Neutral payment adjustment (0%) 45.01 – 84.99 points Positive payment adjustment (scaling factor applied to meet budget neutrality requirements) 85.00 – 100.00 points Positive payment adjustment (scaling factor applied to meet statutory budget neutrality requirements)

Additional (positive) payment adjustment (scaling factor applied to account for funding pool) -

How will my MIPS score affect my medical practice?

Clinicians are rated on a scale of 0 to 100 and how they compare to peers nationally. CMS then publishes final scores a year after data has been reported.

A 2014 JAMA study found that 65% of consumers are aware of online physician rating sites and 36% of consumers have used a ratings site at least once. Exceptional performers will benefit from this free advertising. The same cannot be said for underperformers. In fact, if a clinician's MIPS performance feedback scores are low, their ability to join a group or hospital may be compromised. Potential employers will not want to inherit a clinician's low score and risk lowering their score.

-

What are the episode-based cost measures for the 2020 performance period?

Episode-based cost measures are based on services provided to a patient during an episode of care.

2020 EPISODE-BASED COST MEASURES

Existing/No Change (8) New (10) - Elective Outpatient Percutaneous Coronary Intervention (PCI)

- Intracranial Hemorrhage or Cerebral Infarction

- Knee Arthroplasty

- Revascularization for Lower Extremity Chronic Critical Limb Ischemia

- Routine Cataract Removal with Intraocular Lens (IOL) Implantation

- Screening/Surveillance Colonoscopy

- Simple Pneumonia with Hospitalization

- ST-Elevation Myocardial Infarction (STEMI) with Percutaneous Coronary Intervention (PCI)

Episode-Based Measures:

- Acute Kidney Injury Requiring New Inpatient Dialysis

- Elective Primary Hip Arthroplasty

- Femoral or Inguinal Hernia Repair

- Hemodialysis Access Creation

- Inpatient Chronic Obstructive Pulmonary Disease (COPD) Exacerbation

- Lower Gastrointestinal Hemorrhage (groups only)

- Lumbar Spine Fusion for Degenerative Disease, 1-3 Levels

- Lumpectomy Partial Mastectomy, Simple Mastectomy

- Non-Emergent Coronary Artery Bypass Graft (CABG)

- Renal or Ureteral Stone Surgical Treatment

-

What is a hospital-based clinician?

The 2017 MACRA Final Rule authorized CMS to use measures from other payment systems (e.g., inpatient hospitals) for the Quality and Cost performance categories for "hospital-based" MIPS eligible providers. MIPS eligible providers included those who furnished 75% or more of covered professional services in an inpatient hospital (POS 21), on-campus outpatient hospital (POS 22), or emergency room setting (POS 23) in the year preceding the performance period.

In 2018, CMS modified the definition to include covered professional services furnished by MIPS eligible providers in an off-campus outpatient hospital (POS 19), such as items and services furnished by emergency physicians, radiologists, and anesthesiologists.

-

What changes were made to hospital-based designation for groups in the 2020 performance period?

CMS updated the threshold that determines if a group is considered hospital-based. In 2019, the hospital-based designation required 100% of MIPS eligible clinicians in the group be hospital-based. In 2020, the group is considered hospital-based if more than 75% of the clinicians in the group are hospital-based MIPS eligible clinicians.

-

When will historical quality benchmarks be available for the 2020 performance period?

The 2020 Quality Benchmarks zip file will be posted on the QPP Resource Library, shortly before the performance period begins on January 1, 2020.

-

What is a topped out measure?

A quality measure becomes topped out if meaningful distinctions and improvements in performance can no longer be made. These measures are identified in each final rule. If a measure is identified for 3 consecutive years, it will be eliminated in the fourth year. Topped out measures are capped at 7 points and do not apply to the CMS Web Interface measures.

In the 2020 final rule, CMS identified 2 measures as topped out:

- MIPS #1 NQF 0059 Diabetes: Hemoglobin A1c (HbA1c) Poor Control (>9%)

- MIPS #236 NQF 0018: Controlling High Blood Pressure

-

What are the key 2020 changes for clinicians participating in APMs?

Because quality measures based on an APM's measures aren't always available for MIPS scoring, CMS is providing new quality reporting options for 2020 APM participants to provide flexibility and improve meaningful measurement. As of Year 4, CMS allows APM Entities and MIPS eligible clinicians participating in MIPS APMs the option to report on other MIPS quality measures for the MIPS Quality performance category. APM Entities will receive a calculated score based on individual, TIN, or APM Entity reporting.

Additionally, CMS will apply a MIPS APM Quality Reporting Credit for APM participants in MIPS APMs, where APM quality data are not used for MIPS purposes. These MIPS APM participants will receive a credit equal to 50 percent of the MIPS Quality performance category weight and will have the opportunity to submit quality measures and their score will be added to the credit, subject to a total score cap of 100 for the MIPS Quality performance category.

-

Where can I learn more about MACRA?

While the QPP is meant to simplify the reporting process, the rules are complex and ever evolving. It's essential for Medicare Part B providers to stay current with annual QPP updates as defined in the MACRA Final Rule.

AAPC is dedicated to helping clinicians learn more about MACRA and its effects on healthcare in the United States. You can join AAPC to gain free access to timely news and other essential resources. You can also register for AAPC's MACRA training to learn about the updates and become an invaluable resource for your organization.

-

What is PTAC?

PTAC is an acronym for the Physician-Focused Payment Model Technical Advisory Committee—an independent federal advisory board established by MACRA to review and make recommendations on new Physician-Focused Payment Models (PFPM) that may qualify as Advanced APMs.

Criteria used by the PTAC in evaluating innovative physician-driven payment models include:

- Value over volume—incentives to deliver high-quality care

- Flexibility for practitioners

- Improving quality at no additional cost or at decreased cost. CMS will review PTAC comments and recommendations on proposed PFPMs and post detailed responses to them on the CMS website.

-

What is an APM Entity?

An APM Entity is an organization that participates with an Advanced APM or other APM. Clinicians may join an existing APM Entity or create a new APM Entity. Eligible clinicians participating in an APM Entity are identified by a combination of the APM identifier, APM Entity identifier, TIN, and NPI for each participating eligible clinician.

Most APMs Entities allow clinicians to join throughout the year. It is important to understand the existing regulations for the APM the clinician will be joining.

-

What are AMP Entity Attribution-Eligible Beneficiaries?

Attribution-eligible beneficiaries are the universe of beneficiaries that could be attributed to the APM Entity. Physicians within the entity are incentivized to see patients more frequently who are attributed to them. Different APMs have different rules on what constitutes a patient as "attributed" to an individual provider.

Attribution-eligible beneficiaries are patients who are:

- Not enrolled in HCC MA or a Medicare cost plan

- Do not have MSP

- Are enrolled in both Medicare Parts A and B

- Are at least 18 years of age

- Are U.S. residents; and have a minimum of one evaluation and management (E/M) visit or other qualified service under the rules of the APM

But the definition of attribution is complicated because the same beneficiary may be attribution-eligible for multiple eligible clinicians. For example, a patient who sees one physician for one problem and another physician for a different problem could create confusion regarding who the patient officially "belongs" to on the attribution list. Nonetheless, APM Entities have officially accepted the responsibility of cost and quality of care for the patients on their attribution list.

What Does the Acronym Ehr Stand for

Source: https://www.aapc.com/macra/macra.aspx

0 Response to "What Does the Acronym Ehr Stand for"

Post a Comment