How to Get a Bank Account as a Minor

It's a great feeling to be able to give your child the gift of their very own bank account. But what exactly do you need to open an account for them?

Because minors can't open a bank account by themselves, they'll need your help getting one opened.

We've created this article with everything you'll need to learn how to open a bank account for a minor, what to look for in a bank account, what they can use it for, and what steps are needed!

What Do I Need to Open a Bank Account for My Child?

A minor might be interested in opening a bank account, but their parents or legal guardians will need to open it for them and list themselves as joint owners. The steps will vary depending on the financial institution.

However, according to general procedures for opening a bank account for children, these steps should generally allow you to open a bank account for your children.

How to Open a Bank Account for a Minor

1. Choose the Type of Account You Want (Checking Account vs. Savings Account)

It's quite common for banks to offer checking and savings accounts for kids these days, especially with the advent of banking apps for kids and teens.

Despite this availability, age restrictions still apply in many cases, though they vary by banking institution.

For instance, teenagers generally only have access to kids checking accounts, while kids of nearly any age have access to savings accounts.

In fact, many banking institutions and money apps for kids offer the ability to open savings accounts for babies so you can give financial gifts to babies, kids or grandkids.

If you don't wish to open full blown checking accounts for your children, you can also look into prepaid debit cards for kids and teens.

With apps like Greenlight, you can establish parental controls to monitor, manage and shortlist where your kids shop online and offline alike.

Further, you have the ability to assign chores and disburse allowance payments, offer Parent Paid Interest, automate money transfers and much more.

Many of these money apps for teens come equipped with useful financial literacy tools for you to teach your kids about money and how they can develop teenage money management skills.

If even this presents problems for your needs by still offering access to cash by failing to put in place sufficient safeguards, you can open a custodial account.

These accounts prevent your child from accessing funds until they reach the age of termination (quite often, the age of majority, or adulthood), in their state of residence.

Among many available options, custodial brokerage accounts allow you to save for future expenses ranging from college, to a car, wedding or even down payment on a home.

You can even establish a Roth IRA for kids if your children have earned income and thus the ability to contribute to a retirement account.

With decades of tax-free growth, Roth IRAs are a powerful way to leverage compounding returns to a child's benefit.

2. Submit an Application

Once you've chosen a bank and an account that fits your needs, you can apply for the new account.

A bank account is a valuable start to your child's financial independence and can help prepare them for the future.

One of the first decisions you'll need to make is which type of account will work best for different needs, be it saving or spending money.

You may need to visit a bank in person but you may find many banks, credit unions and fintech apps now allow for you to apply online.

In either case, the application process should only take about 10-15 minutes.

3. Fund the Account and Activate the Debit Card

As a condition for opening joint accounts with a minor, you often need to fund the account at opening as part of the final stage of the application process.

Placing funds into your child's account can usually be done with a debit card, credit card or existing bank account. There may be some institutions where restrictions vary.

If you opened a checking account, your account may come paired with a free debit card or bank card your kid can use to make purchases or make withdrawals from their deposit accounts.

If so, this card usually takes 1-2 weeks to arrive in the mail after receiving approval of your application, though some banks and credit unions offer temporary cards immediately.

No matter the timing of when your child receives their debit card, you need to activate the card either online through a secure web portal or by telephone through a toll-free number provided on the card at receipt.

Many modern banking apps also allow you to activate it through a smartphone app and even carry the card in a digital wallet like Apple Pay (age 13+) or Google Pay (age 16+).

If your bank account offers a mobile app, (most do these days), whether opened with a traditional bank, credit union or other financial institution, you should consider downloading it on your phone.

These allow you and your child to check the children's savings account balance as well as monitor any account fees, transactions and more.

Further, you can use these mobile apps to monitor account activity or restrict access to funds.

Several of today's most popular apps, including Greenlight and BusyKid, let parents assign chores and pay allowance through apps with just a few taps on their smartphones.

How Old Do You Have to be to Open a Kids Bank Account?

To open a teen checking account, the parent or accompanying adult must be at least 18 years of age (or the age of majority in the state of residence) and typically the child must be under the age of 18.

But some banks may impose stricter age requirements for kids, requiring them to be under the age of 12 or between certain ages like 13 to 17.

Likewise, you might be able to open a joint account allowing both the adult and minor to be on the same account title.

What Do I Need to Open a Bank Account for My Kids?

Now, you can open a banking account with debit card for your child with a few clicks of a button, thanks to digital systems and fintech apps.

As part of the U.S. Patriot Act, the government requires financial institutions to help fight the funding of terrorism and money laundering activities. Therefore, federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account.

For you, this means you'll need to supply your target bank with some necessary information when looking to open an account. This includes information like:

- Your name

- Address

- Date of birth

- Social security number

- Valid government-issued ID

To open a checking account with banks like Wells Fargo, Bank of America, U.S. Bank, or Capital One, a deposit account with a credit union, or even mobile banking apps like Greenlight, you will need to supply a handful of important pieces of documentation.

Afterward, your kid can start making deposits into these joint accounts, working toward financial goals, using a paired ATM card and managing their money.

While what you need may vary by institution, but the information above will be standard requirements. The account holder will need to provide all or some variation of the above items the joint account held between the minor and parent or guardian with the following documents:

- Your driver's license

- Your Social Security number

- Your child's Social Security number (potentially a Social Security Card)

- Your child's birth certificate

- Proof of address (usually a utility bill)

Features to Consider for Opening Bank Account for Your Kid

Keep these factors in mind when looking for a bank account for your child.

- Mobile banking app. Because kids control most of their information through their phones, having a service provider who can provide online banking and management capability is imperative. The interface needs to provide great functionality including the ability to transfer funds, set spending limits, provide text or email alerts and work for multiple accounts if there are several account holders.

- Checking and savings account.Make sure you can segregate your child's funds in a kids savings account and a separate checking account. This can help with developing a savings mindset. Likewise, you can use many of the popular banking apps for minors to create savings pods that designate money held in the joint account for specific savings goals.

- Consider the fee menu (monthly, recurring, transactions, ATM withdrawals, card reload, etc.). Savings accounts for kids make building a nest egg easy and accessible, but they typically come with a monthly service fee, monthly maintenance fee for having the account. In fact, some might come with other fees which make having the account cost prohibitive, like ATM withdrawal fees, card reload fees, annual card fees and more. There are many fees businesses charge to open bank accounts. Sometimes they're not as obvious and you won't know how much is going to be charged until it's time to sign up for the account.

- Linked debit card (with parental controls). Your child may be eligible for a debit card or ATM card to spend or access the account if they open eligible bank accounts at a banking, fintech company or credit union. Parents should be able to set spending and account limits, request text or email alerts for transactions and deposits, add/remove authorized users on the account from a mobile banking app and receive notifications when their child uses the debit card.

- Interest income. Most kids savings accounts earn a small amount of interest, along with many other high-yield savings accounts available only to adults. Low rates offer little passive income, but you can still find a few which earn competitive APYs. Kids checking accounts don't always accrue interest, although it is possible. Some apps allow you to be the interest payer through a feature like Parent Paid Interest.

Compare the Best Online Bank Accounts for Kids

Compare these best online bank accounts for kids that let them save, spend and learn how to manage their money.

1. Greenlight Card

- Available: Sign up here

- Price: Free 1-month trial, $4.99/mo after

Greenlight provides parents control over where their kids can spend money by limiting the stores where their cards work.

Parents can get alerts when money is spent on the Greenlight debit card and for how much.

Greenlight works like a prepaid debit card, allowing you to transfer money onto the card for your child to pay for expenses at approved locations.

You can choose how much money to load onto the card and your child will be cleared to make approved purchases so long as a money balance backs up the card.

If your child asks for extra money to get added to the card, you can have them take a photo of the purchase they want to make and receive your approval.

This gives you control and allows kids to discuss why a purchase either is a good or bad idea.

If your child has a job, they can add their own funds to the card as well.

The Greenlight debit card is a good choice for parents looking to teach their kids the importance of saving money and making prudent financial decisions.

This financial product can be an effective learning tool for helping kids to understand why saving should be a priority and how to simplify paying an allowance or tracking chores.

It's also a rapidly growing app many parents have come to use for raising financially-smart kids.

Read more in our Greenlight Card review.

Our Investing & Debit Card for Kids Pick

Greenlight | The Investing App and Debit Card for Kids

Greenlight | The Investing App and Debit Card for Kids

- Greenlight offers flexible parental controls for each child and real-time notifications of each transaction.

- Greenlight is the only debit card letting you choose the exact stores where kids can spend on the card.

- Parents can use this app to teach them how to invest with a custodial account through Greenlight Max

Related: Best Greenlight Alternatives [Debit Cards for Kids & Teens]

2. goHenry

- Available: Sign up here

- Price: 1 month free, then $3.99 per child/mo

goHenry is a banking app for minors that comes paired with a debit card. You have an online account which comes linked to individual accounts for each of your children.

You can manage all of the money held in each account through the company's app and online account portal.

Each child will receive their own goHenry debit card which comes paired with parental controls you can set for your children.

What's nice about goHenry is the ability to spend only the money available on the card, meaning you don't need to worry about costly overdraft fees or accrue debt.

You open a goHenry account, receive your children's debit cards in the mail 7-8 business days later, set up an automatic weekly allowance transfer into your children's accounts and can set up one-off or weekly spending limits.

This will keep your children's spending in check and you can block/unblock the card as needed as well as choose the stores where your kids can shop.

With time, the controls provided by the app and the guidance you offer can help your kids to earn, save, spend and give with good money habits.

Learn more by reading our goHenry debit card for kids review.

goHenry | Kids' Debit Card & Financial Education App

goHenry | Kids' Debit Card & Financial Education App

- A financial app and debit card designed to give young people ages 6 - 18 a bright financial future

- Kids can earn allowance, complete chores, set savings goals, give to charity and bank with goHenry

- Use the app to build a solid financial education

Related: goHenry vs. Greenlight: Which is the Best Debit Card for Teens?

3. Acorns

- Available: Sign up here

- Price: Acorns Lite: $1/mo, Acorns Personal: $3/mo, Acorns Family: $5/mo

Acorns has become one of the most popular micro investing apps for kids and young adults by offering a robust money management platform.

The full suite of offerings includes the ability to establish custodial accounts for minors to invest, regular and retirement investment accounts for adults and a bank account with linked debit card.

If you sign up for the Acorns Spend product, it creates a bank account that carries FDIC Insurance protection for up to $250,000.

Further, it uses the Acorns "Round Ups" feature which rounds up purchases to the nearest dollar, investing the difference between the transaction amount and the whole dollar. The service claims to help users invest an average of $30/month using this feature.

While not a free stock trading app, Acorns does give you the following subscription options:

- Acorns Lite ($1/mo) : Includes the Acorns Invest plan, which invests spare change through the popular "Round-Ups" feature, earns bonus investments and provides access to financial literacy articles

- Acorns Personal ($3/mo): Everything on Acorns Lite (Investing), plus it also includes Acorns Later for tax-advantaged investment options like individual retirement accounts (IRAs) and Acorns Spend. This service acts as your bank account, offering free withdrawals at over 55,000 ATMs nationwide and no account fees and the ability to earn up to 10% bonus investments

- Acorns Family ($5/mo): Everything in Acorns Personal (Acorns Invest, Later and Spend), plus Acorns Early. This allows you to open a custodial account for your child and begin investing for them as a minor.

For a limited time, the service also offers a $10 sign up bonus for people who open an account.

Learn more in our Acorns review.

Our Micro-Investing App Pick

Acorns | Invest, Earn, Grow, Spend, Later

Acorns | Invest, Earn, Grow, Spend, Later

- From acorns, mighty oaks do grow. Grow your oak!

- In under 5 minutes, get investment accounts for you and your family, plus retirement, checking, ways to earn more money, and grow your knowledge.

- Famous for investing spare change automatically through Round-Ups, this all-in-one financial app helps younger generations start investing earlier.

- Just $3 or $5/mo.

- Bonus: Get $10 to start & $75 for taking specific actions in an Acorns Checking account*

* Must receive 2 or more direct deposits of at least $250/deposit and spend at least $500 from the Checking account within 3 months of first qualifying deposit. $75 bonus will be deposited into your Acorns account within 45 days.

Related: Best Acorns Alternatives: Micro-Investing Apps to Use

4. Stash

- Available: Sign up here

- Price: Starts at $1/mo

Stash is an all-in-one personal finance management platform. The app includes a mobile-friendly investing app for beginners and comes paired with a checking account and debit card.

Stash caters to people looking to begin managing their money and invest as you spend money and make recurring deposits into your account. You can also pair the subscription with a stock news app or site to learn more about the market.

You can grow your account balances over time by making regular deposits, utilizing its round ups feature, or "Stock-Backs," on your purchases.

This essentially substitutes for the cash back features seen on some credit and debit cards, paying you in free stocks as opposed to cash back.

Stash | Investing Made Easy

Stash | Investing Made Easy

- Stash is a personal finance app that simplifies investing, making it easy and affordable for everyday Americans to build wealth and achieve their financial goals.

- By signing up and making a $5 deposit, Stash will also provide a $5 sign up bonus.

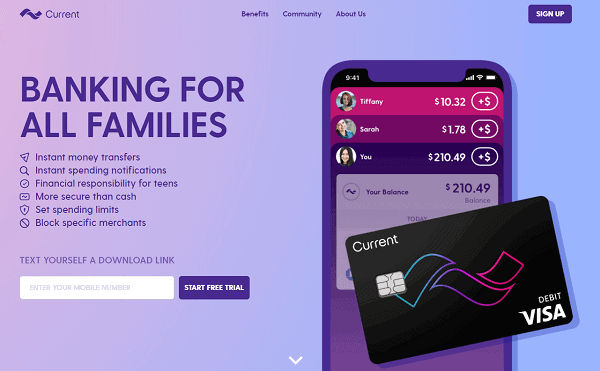

5. Current

- Available:Sign up here

- Price: $36/teen per year

Current is a banking app designed for all families. The Current app allows you to track your teen's spending in real-time, set limits on how much they can spend, and even block specific merchants.

You also get the peace of mind that comes with knowing their money is safe because it's not cash. Plus, the company doesn't charge any fees or interest for student accounts so there are no surprises when bills arrive.

Current helps parents teach teens financial responsibility while giving them a way to learn without having cash around the house and all its temptations.

That means less worry for both parents and kids! With Current, your teenager will be able to do everything from paying friends back to buying groceries at the store–all safely with only her phone!

And teens will have the opportunity to learn financial responsibility and budgeting from an early age. This will allow them to grow their savings and move one step closer to financial independence.

Read more in our Current review.

Current | Banking for All Families

Current | Banking for All Families

- Instant money transfers and spending notifications

- Develops financial responsibility for teens

- Parents can set spending limits and block specific merchants

- Families can control their money together, saving for goals and working toward financial goals

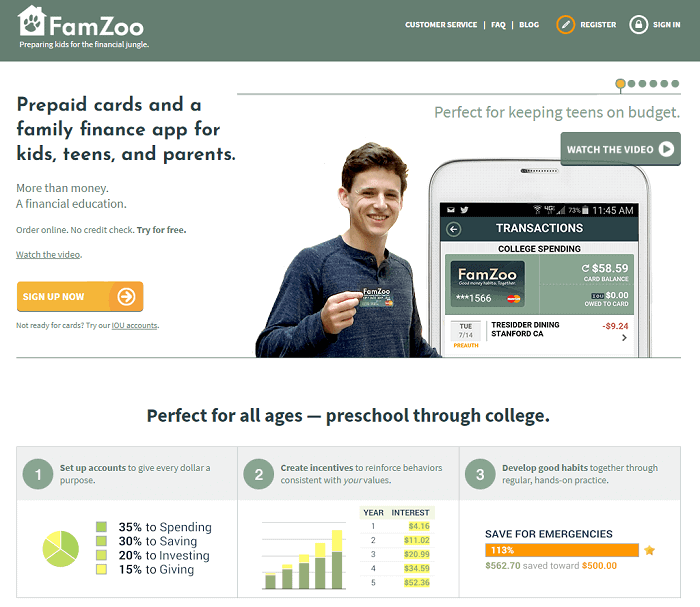

6. FamZoo

- Available: Sign up here

- Price: Free trial, then $5.99/mo

FamZoo is another prepaid debit card service parents can use to manage their children's spending. It works by having parents release money into their child's account and then having the card work with a loaded balance. Money can be loaded onto the cards at any time.

FamZoo acts like a regular checking account with a linked debit card except FamZoo makes sure the account can't be charged overdraft fees, saving you money.

Adults are able to monitor the transactions being made. After a free trial, this app costs $5.99 per month, but the price goes down if prepaid in advance.

Related: Greenlight vs. FamZoo: Who Has the Best Debit Card for Teens?

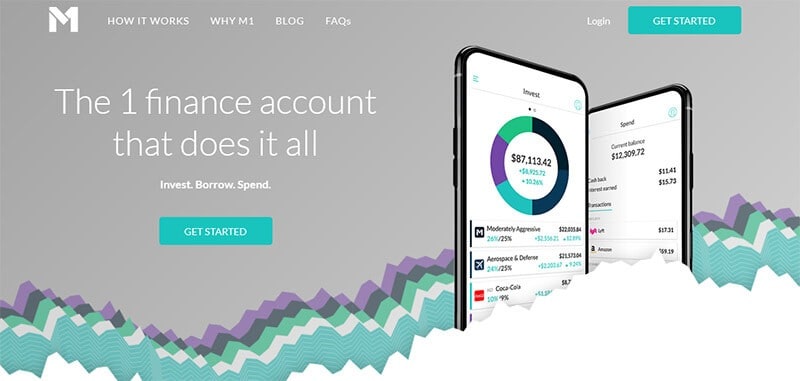

7. M1 Finance

- Available:Sign up here

- Price: Free trades, M1 Plus costs $125/year

M1 Finance is an all-in-one super app that does it all. The app allows you to invest, borrow and spend but also open aM1 Finance custodial account to allow your kids to use it as an investment app as well.

The service requires you to sign up for M1 Plus to do this, however. Be sure to watch out for when the company puts this on promotion, making it free for you to try.

If you hold money in the app's free checking account, it comes withFDIC insurance coverage and is part of the entiresafe M1 Finance financial app experience.

Read more about this app in ourM1 Finance review.

Our Robo-Advisor Pick

M1 Finance | Smart Money Mgmt

M1 Finance | Smart Money Mgmt

- M1 Finance's Smart Money Management gives you choice and control of how you want to invest automatically, borrow, and spend your money—with available high-yield checking and low borrowing rates.

- Special Promotions: Open an account and make a $1,000 deposit within 14 days to receive a $30 bonus and get 1-year free of M1 Plus ($125 value).

Are Money Apps for Kids Safe?

The best way to teach kids about money is by giving them a role in making and spending it. To maximize the value children receive for their money, they need to manage and invest.

It is important to establish good money habits for a child early so that they will have less fear of money topics and be developing good financial literacy skills.

The previous apps are some of the best to consider for your children.

These apps require a parent or guardian to open the account if the owner is a minor, but will transition to the account owner's name after turning the age of majority (18 or 21 in some states for financial items).

These banking apps for minors come with cybersecurity controls, multi-factor authentication and banking integration through Plaid, a leading cybersecurity provider in the financial industry.

The money kept in these bank accounts carry standard FDIC insurance coverage. This type of insurance protects your deposits held in the account up to $250,000 in value in the event of a bank failure.

These apps offer a safe and secure experience for kids, teens and minors. But, just like any other bank account, children are at risk of scams.

Parents need to teach their children about safe money handling processes and how to be mindful of phishing scams or attempts by others to steal their money.

Do Kids Bank Accounts Have Online Applications?

The answer to this question will depend on the bank. Some banks let you open an account online; others will require that you visit your nearest branch to prove your identity.

To open a bank account online for your child, you'll need to upload photos proving your and your child's identities.

What Do I Need to Know About Taxes with Kids' Bank Accounts?

Yes, you may face tax implications for having a bank account or custodial account which pays interest or other investment income. This applies to any unearned income, including interest, dividends or capital gains.

The taxes you face depend on the type of account you set up, but all follow the same Kiddie Tax Rules by the IRS with respect to unearned income.

- Savings accounts. If your child makes more than $2,200 in unearned income (interest income in this case) in a given tax year, you and they may need to pay taxes.

- Custodial accounts. If a UGMA or UTMA account makes more than $2,200 in unearned income from interest, dividends or capital gains in a year, the minor and yourself will likely need to pay taxes.

- Trust funds.Minor beneficiaries and other beneficiaries of a trust fund are responsible for paying taxes on any unearned income produced and distributed by the trust. Trusts may be subject to taxation if distribution is made. Tax liability can change depending on the size and nature of the trust as well as applicable tax laws. If you're considering setting up a trust fund, consider visiting Trust & Will to learn more about your options and how a trust will be taxed.

Gifting Money to a Child's Account

As of 2021, you can gift up to $15,000 per year to a single person without needing to document the financial gift with the IRS.

This means you can learn how to gift stock to a UGMA account without paying any extra taxes. If you have a spouse, they can also gift up to $15,000 per year.

What Do I Need to Open a Child Bank Account with a Debit Card?

A bank account for your child is a great way to teach them about money and what it takes to have one.

To open an account for your child, you need certain types of documentation to support identities and citizenship and then the process you'd likely face for applying and opening the account.

From there, you need to manage the account held at a bank, credit union or online banks through leading financial apps for kids.

Your job as a joint account holder is to manage money and help them to develop their own money management skills.

Next, you may need to look into credit cards for your kid, which will require credit approval and understanding interest rates (and how not to pay them by paying off your credit card each month).

How to Get a Bank Account as a Minor

Source: https://youngandtheinvested.com/how-to-open-a-bank-account-for-a-minor/

0 Response to "How to Get a Bank Account as a Minor"

Post a Comment